|

| StandBy Letter of Credit (SBLC/SLOC) Meaning, Types & Uses |

1. What is Standby Letter of Credit (SBLC/SLOC)?

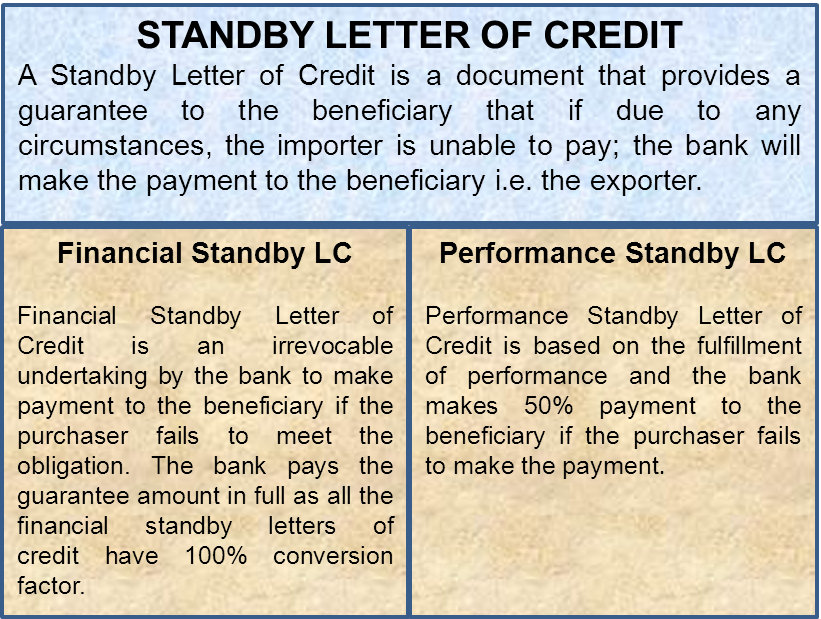

A standby letter of credit (SBLC or SLOC) is a

guarantee of payment by a bank on behalf of their client. It is a loan

of last resort in which the bank fulfills payment obligations by the end

of the contract if their client cannot.

A standby letter of credit can also be abbreviated SBLC or SLOC. A standby letter of credit is different from a bank guarantee.

A standby letter of credit can also be abbreviated SBLC or SLOC. A standby letter of credit is different from a bank guarantee.

2. Types and Examples of Standby Letter of Credit (SBLC/SLOC)

Financial standby LOC: An

exporter sells goods to a foreign buyer, who promises to pay within 60

days. If the payment never arrives (and the exporter required the buyer

to use a standby letter of credit) the exporter can collect payment from

the importer’s bank. Before issuing the letter of credit, the bank

typically evaluates the importer’s credit and determines that the

importer will repay the bank. But if the customer’s credit is in

question, banks may require collateral (or funds on deposit) for

approval.

Performance standby LOC: A

contractor agrees to complete a construction project within a certain

timeframe. When the deadline arrives, the project is not complete. With a

standby letter of credit in place, the contractor’s customer can demand

payment from the contractor’s bank. That payment functions as a penalty

to encourage on-time completion, funding to bring in another contractor

to take over mid-project, or compensation for the headaches of dealing

with problems. This is an example of a “performance” standby

letter of credit, and a failure to perform triggers the

payment.

3. Advantages of a Standby Letter of Credit (SBLC / SLOC)

An SBLC helps ensure that the buyer will receive the goods or service

that's outlined in the document. For example, if a contract calls for

the construction

of a building and the builder fails to deliver, the client presents the

SLOC to the bank to be made whole. Another advantage when involved in

global trade, a buyer has an increased certainty that the goods will be

delivered from the seller.

Also, small businesses can have difficulty competing against bigger

and better-known rivals. An SBLC can add credibility to its bid for a

project and can often times help avoid an upfront payment to the seller.

For the business that is presented with a SLOC/SBLC, the greatest

advantage is the potential ease of getting out of that worst-case

scenario. If an agreement calls for payment within 30 days of delivery

and the payment is not made, the seller can present the SLOC to the

buyer's bank for payment. Thus, the seller is guaranteed to be paid.

Another advantage for the seller is that the SBLC reduces the risk of

the production order being changed or canceled by the buyer.

4. Uses of SBLC / SLOC

A standby letter of credit helps facilitate international trade between companies that don't know each other and have different laws and regulations. Although the buyer is certain to receive the goods and the seller certain to receive payment, a SLOC doesn't guarantee the buyer will be happy with the goods.

The SBLC / SLOC is often seen in contracts involving international trade,

which tend to involve a large commitment of money and have added risks.

4. Uses of SBLC / SLOC

A standby letter of credit helps facilitate international trade between companies that don't know each other and have different laws and regulations. Although the buyer is certain to receive the goods and the seller certain to receive payment, a SLOC doesn't guarantee the buyer will be happy with the goods.

A

standby letter of credit is most often sought by a business to help it obtain a contract.

The contract is a “standby” agreement because the bank will have to pay

only in a worst-case scenario. Although an sblc/sloc guarantees payment to a

seller, the agreement must be followed exactly. For example, a delay in

shipping or a misspelling a company’s name can lead to the bank refusing

to make the payment.There are two main types of standby letters of

credit:A financial sblc/sloc guarantees payment for goods or services as

specified by an agreement. An oil refining company, for example, might

arrange for such a letter to reassure a seller of crude oil that it can

pay for a huge delivery of crude oil.

Standby letters of credit can help establish trust with your business

partners and be a powerful tool to help meet your business goals.

Please note that Standby Letter of Credit (SBLC/SLOC) is different from Letter of Credit (LC).

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade,

where the reliability of contracting parties cannot be readily and

easily determined. Its economic effect is to introduce a bank as an underwriter, where it assumes the counterparty risk of the buyer paying the seller for goods

The major difference: The ‘Letter of Credit’ and the ‘StandBy Letter of

Credit’ are two legal bank documents that are used by international

traders. Both these letters are used to ensure the financial safety

between the supplier and their buyers. And, SBLC is a type of LC that is

used when there is a contingent upon the performance of the buyer and

this letter is available with the seller to prove the buyer’s

non-performance during the sale.

LC and SBLC are the two financial instruments that are meant to safeguard the financial interests of the international traders i.e. buyers and sellers. It simply means that both these terms are widely useful while making transaction between the two trading parties. These help in giving financial security to both the parties. Also, these contracts are produced in good faith and in both the cases the fund gets mobilized.

LC and SBLC are the two financial instruments that are meant to safeguard the financial interests of the international traders i.e. buyers and sellers. It simply means that both these terms are widely useful while making transaction between the two trading parties. These help in giving financial security to both the parties. Also, these contracts are produced in good faith and in both the cases the fund gets mobilized.

6. The cost and charges of SBLC/SLOC

The fee or charge to obtain a standby letter of credit is between 1-10% of the SBLC/SLOC amount before issuing the sblc/sloc. This fee is usually charged per year that the letter of credit is in effect. If the sblc/sloc is needed for more than one year, there will be an option of rolls and extensions where applicable. If the terms of the contract are fulfilled early, you can cancel the SLOC/SLBC without incurring additional charges.

7. The Process & How to Obtain a Standby Letter of Credit (SBLC / SLOC)

Standby Letter of Credit (sblc/sloc) is a financial instruments issued by banks and other financial institutions such as Kingrise Finance Limited. This financial instrument is used to obtain loan and financing from banks, it can also be used for trade financing, foreign exchange transactions as well as in import and export transactions.

As with any business loan, you will need to provide proof of your creditworthiness to the bank. However, the SBLC / SLOC approval process is much quicker, with letters often being issued within a week of all paperwork being submitted.

One of

the easiest and best ways to obtain a bank Guarantee (BG) Is through Kingrise

Finance Limited.

Kingrise Finance Limited was

incorporated in Hong Kong on 22-SEP-1999 as a Government Licensed Money Lender

with CR No.: 0689078. We are

leading providers of Business Loan, SME Loans, Project Financing, Recourse Loan, Non Recourse Loans

and Bank Financial Instruments such as Standby Letter of Credit Funding, Bank

Guarantee, Performance Guarantee Bond, Tender Bond Guarantee, Advance Payment

Guarantee, Bank Comfort Letter, BG/CD/BD/BCL/DLC/LOC/SLOC/SBLC etc.

Our bank

instruments, bg/sblc issuance and monetization process is simple, fast and

efficient and we offer the best rates as well as the best LTV in the industry.

Our bank

instruments, bg and sblc/sloc are issued from prime banks such as Barclays

Bank London, Standard Chattered Bank, HSBC

Hong Kong or any rated AAA bank of your choice. All our financial

instruments are Cash-Backed and can be used as collateral to secure funding for

projects, Discounting, Monetization and Private Placement Programs (PPP)..

Why Choose Us?

- Fast Turnaround

- Best Top Rated Banks

- Competitive Low rates

- No prepayment penalty

- 2 Days for Commitment

- Extremely Satisfied Clients

- WE KEEP OUR PROMISE

- 20 Years of Experience & Trust

- No Personal Collateral Required

- Solutions for every customer & every industry.

- Loan amounts from $1 million to over $500 million

- Fast Approvals & Fast Funding- Closing in as little as 5 days

BROKERS: We welcome new brokers who are

direct to their client. New brokers are welcomed and are

rewarded with 2% commission on every deal they bring to us.

Kindly

contact Us today for all your funding needs, including business loan, sme

Loans, project financing, Lease bg, Lease sblc, Bank Guarantee Provider

Website: www.kingrisefinance.com

Email: info@kingrisefinance.com

No comments:

Post a Comment